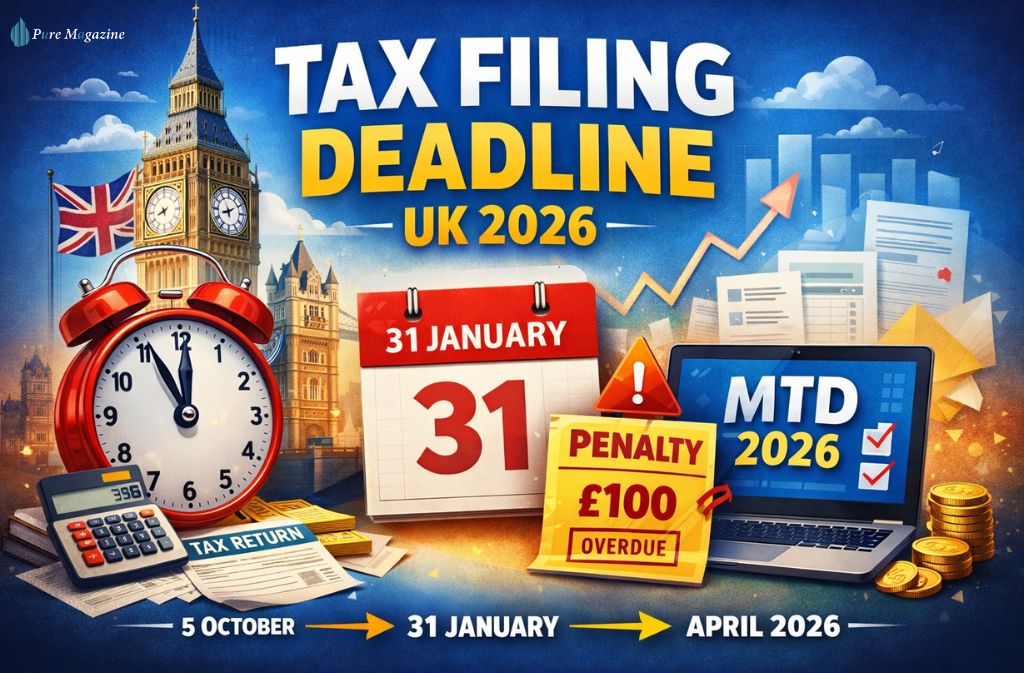

Tax Filing Deadline UK 2026: Key Dates & Penalties

TL;DR – 2026 Snapshot UK tax year runs 6 April to 5 April Online Self Assessment deadline → 31 January Register by 5 October (the hidden deadline) Automatic £100 fine for missing filing deadline First high-profit year? Your January bill can feel like 150% of expected MTD starts in April 2026 for income over £50,000