If you practice medicine long enough, you will eventually hear this advice: “If your policy is claims-made, understand tail coverage before you sign anything.”

That warning exists for a reason. The difference between claims made and occurrence malpractice insurance is not academic. It directly determines whether you are protected years after patient care takes place or whether you must purchase additional coverage to avoid a dangerous gap.

This article explains, in clear terms, why claims made policies require tail coverage and why occurrence policies do not.

The Core Difference Comes Down to Timing

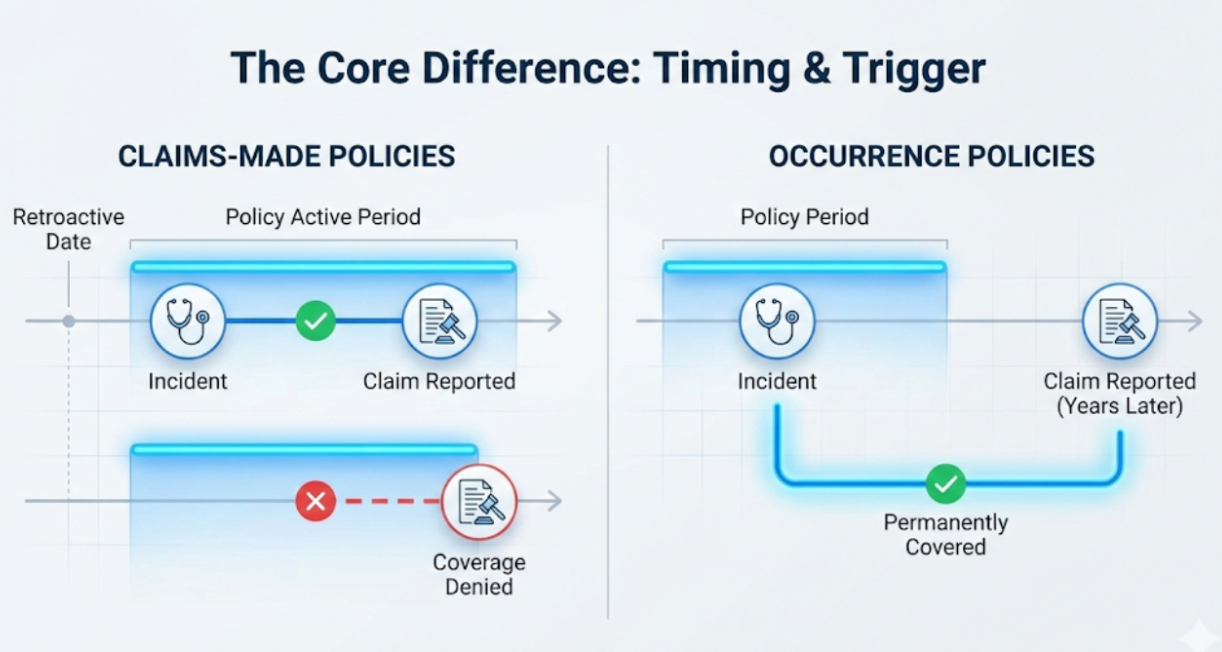

Medical malpractice claims rarely appear immediately. A procedure performed today can result in a claim years later. The way your policy responds depends entirely on how coverage is triggered.

Claims Made Policies

A claims-made policy provides coverage only when both of the following are true:

- The incident occurred after the policy’s retroactive date

- The claim is reported while the policy is active

If either condition fails, coverage does not exist.

Occurrence Policies

An occurrence policy provides coverage based solely on when the incident occurred.

If the event happened during the policy period, the claim is covered no matter when it is filed, even decades later.

This single distinction explains everything that follows.

Why Claims-Made Policies Require Tail Coverage

When a claims-made policy ends, coverage stops for any future claims unless action is taken.

Common reasons a claims-made policy ends include:

- Changing employers

- Switching insurance carriers

- Retiring from clinical practice

- Losing employer-sponsored coverage

- Nonrenewal or cancellation

Once the policy terminates, you are no longer allowed to report new claims for past care. This is where tail coverage becomes essential.

What Tail Coverage Actually Does

Tail coverage, also known as an extended reporting period, allows you to report claims after the claims-made policy ends for care that occurred while the policy was active.

Without tail coverage:

- A claim filed tomorrow for care you provided years ago would be uncovered

- You would be personally responsible for defense costs, settlements, or judgments

In practical terms, tail coverage protects your past work once your current policy is no longer in force.

Why Occurrence Policies Do Not Require Tail Coverage

Occurrence policies permanently lock in coverage for each policy year.

If you carried an occurrence policy in 2020 and a claim is filed in 2035 related to that year, the 2020 policy responds. No reporting deadline applies.

Because coverage is tied to the date of service, not the date the claim is filed, there is no need to extend reporting rights when the policy ends.

This built-in permanence is why occurrence policies never require tail coverage.

A Simple Real World Example

Imagine two physicians performing identical procedures in the same year.

Physician A has a claims-made policy

Physician B has an occurrence policy

Five years later, both physicians are named in lawsuits related to that procedure.

Physician A

If their claims-made policy ended and no tail coverage was purchased, the claim is uninsured.

Physician B

The occurrence policy from that year automatically responds, regardless of current employment or insurance status.

The difference is not skill or risk. It is a policy structure.

Why Claims-Made Policies Are Still So Common

If occurrence policies eliminate tail risk, why do so many physicians carry claims-made coverage?

There are several reasons:

- Lower upfront premiums in early years

- Employer preference in group settings

- Greater availability in certain states and specialties

- Easier portability when moving between employers if nose coverage is arranged

Claims-made policies are not inferior, but they require more planning.

Ignoring tail coverage is where physicians get hurt.

When Tail Coverage Becomes Mandatory

Tail coverage is typically required when:

- Leaving an employer that provided claims-made coverage

- Retiring from practice

- Switching from claims made to occurrence coverage

- Closing or selling a private practice

Many employment contracts explicitly require the physician to purchase tail coverage at termination. Others assign that cost to the employer. The financial impact can be substantial, making early understanding critical.

How This Impacts Career Decisions

The tail obligation attached to claims-made policies can influence:

- Job transitions

- Retirement timing

- Contract negotiations

- Choice of insurance structure early in a career

Physicians who understand this difference early can negotiate better terms, avoid unexpected expenses, and protect long-term financial stability.

This is one area where specialized guidance matters. Firms like PLI Consultants focus specifically on helping physicians navigate claims-made coverage, tail exposure, and cost-efficient exit strategies.

The Bottom Line

Claims-made policies require tail coverage because coverage ends when the policy ends.

Occurrence policies do not exist because coverage is permanently tied to the date of the incident or injury.

Neither structure is inherently wrong. The risk arises from a misunderstanding of how each one works.

If you know which policy you have and what happens when it ends, you stay protected. If you do not, the consequences can surface years later when there is no easy fix.

Understanding this difference is not optional. It is fundamental to protecting your career, your finances, and your peace of mind.

For more, visit Pure Magazine