You’re filling out a bank form.

Or maybe a W-9.

Or PayPal just emailed you asking for “Taxpayer Identification Number.”

You pause.

“Is that my SSN? My business number? Something else?”

That moment of hesitation is exactly why thousands of people search every month:

What is a TIN number?

Here’s the short answer:

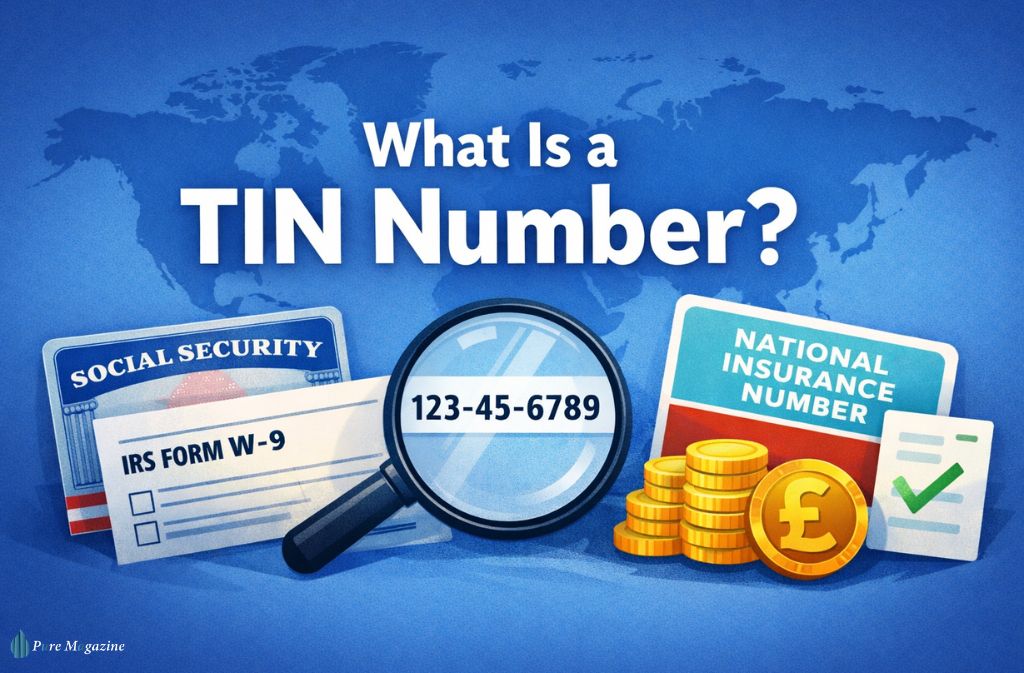

TL;DR A TIN (Taxpayer Identification Number) is a government-issued number used to identify you (or your business) for tax purposes.

Now let’s unpack this properly — without the jargon. |

What Is a TIN Number?

A TIN is a unique identifier issued by a government tax authority to track income, tax filings, and compliance.

It allows tax agencies to:

- Process tax returns

- Match reported income

- Prevent fraud

- Enforce withholding rules

- Share financial data under global agreements (FATCA / CRS)

Think of a TIN as your financial fingerprint.

It follows you through every official money transaction.

But here’s the key detail most articles miss:

TIN isn’t one specific number.

It’s a category.

What Is a TIN Number in the United States?

In the US, “TIN” is a blanket term used by the IRS.

Your TIN depends on who you are.

| Type | Who Uses It | Issued By | Format Example |

|---|---|---|---|

| SSN | Employees / Individuals | SSA | 123-45-6789 |

| EIN | Businesses | IRS | 12-3456789 |

| ITIN | Non-residents | IRS | 9XX-XX-XXXX |

| ATIN | Temporary child ID | IRS | 9XX-XX-XXXX |

Source: IRS.gov

Quick clarity:

- If you’re employed → your SSN is your TIN

- If you own an LLC → your EIN is your TIN

- If you’re a non-resident without SSN → your ITIN is your TIN

Same umbrella. Different numbers.

What Is a TIN Number in the UK?

The UK doesn’t commonly use the word “TIN” in everyday tax language — but equivalents exist.

UK TIN equivalents:

| Situation | Your TIN Equivalent |

|---|---|

| Employee | National Insurance (NI) Number |

| Self-employed | Unique Taxpayer Reference (UTR) |

| Company | Company UTR |

Example formats:

- NI: AB 12 34 56 C

- UTR: 1234567890

Source: HMRC.gov.uk

If a US company asks for your “Foreign TIN” (FTIN) on a W-8BEN form, they usually mean your NI number or UTR.

TIN Number Format Examples (Snippet-Ready Section)

Here’s what different TIN formats look like:

US SSN: 123-45-6789

US EIN: 12-3456789

US ITIN: 9XX-XX-XXXX

UK NI: AB 12 34 56 C

UK UTR: 1234567890

Canada SIN: 123 456 789

Australia TFN: 123 456 789

India PAN: ABCDE1234F

Why Is a TIN Number Required?

You need a TIN for:

- Filing tax returns

- Receiving 1099 income

- Completing a W-9

- Opening business accounts

- Getting paid on platforms (Etsy, Amazon, Fiverr)

- Claiming tax treaty benefits

- FATCA / CRS compliance

As of 2026, digital platforms are legally required to collect verified tax IDs under global transparency rules.

If you’ve ever had Etsy freeze payouts “pending tax verification,” this is why.

How to Apply for a TIN (US & UK Step-by-Step)

How to Apply for an EIN (US Business TIN)

- Go to IRS.gov EIN application portal

- Complete online application

- Receive EIN immediately (if eligible)

- Confirmation letter (CP 575) issued

Processing time: Instant online (business hours)

How to Apply for an ITIN (US Non-Resident)

- Complete Form W-7

- Provide a passport or a certified ID

- Mail to IRS or apply through a Certified Acceptance Agent

Processing time: 7–11 weeks (IRS estimate)

How to Get a UTR in the UK

- Register as self-employed on the HMRC website

- Create a Government Gateway account

- Receive UTR by post

Processing time: 10–14 days typically

What Happens If You Don’t Have a TIN?

This is where things get uncomfortable.

In the US:

- 24% backup withholding may apply (IRS rule)

- Form 1099 may be rejected

- Payments delayed

In the UK:

- Inability to file self-assessment

- Penalties for late registration

If your TIN is incorrect?

Expect:

- Refund delays

- Account freezes

- IRS “B-Notice” letters

Source: IRS backup withholding guidance.

TIN vs SSN vs EIN (Clear Comparison)

| Feature | TIN | SSN | EIN |

|---|---|---|---|

| Category or specific? | Category | Specific | Specific |

| Used by | Individuals & businesses | Individuals | Businesses |

| Issuer | IRS/SSA | SSA | IRS |

| Required for W-9? | Yes (as SSN or EIN) | Yes | Yes |

TIN = umbrella term

SSN/EIN = specific numbers under it

Tax Forms & TIN: W-9, W-8BEN, FATCA

If you’ve seen “Enter your TIN” on:

- W-9 → US persons provide SSN or EIN

- W-8BEN → Foreign individuals provide Foreign TIN

- W-8BEN-E → Foreign entities provide business TIN

Under FATCA (Foreign Account Tax Compliance Act), financial institutions must collect TINs to report offshore accounts.

This is why even non-US residents get asked for tax numbers by US platforms.

Digital Nomads & Platform Workers (2026 Reality)

Imagine:

You’re a UK YouTuber receiving AdSense payments from the US.

Google asks for your Foreign TIN on W-8BEN.

That’s your NI number.

Or:

You’re a freelancer in Spain using Deel to invoice US clients.

You’ll provide your local TIN for treaty benefits.

Cross-border income is normal now.

TIN reporting is automatic.

Also Read: UK Micro Influencers Tax Obligations 2026: DPR, Gifted Products & HMRC Nudge Letters

Is a TIN a Public Record?

No.

TINs are private identifiers.

Never:

- Post on social media

- Email without encryption

- Store in shared cloud docs

Identity theft involving SSNs and EIN fraud increased significantly over the past decade, according to IRS identity protection reports.

Scam alert (2026 trend):

Fake “EIN registration services” charge high fees for free IRS applications.

Always apply directly via official government sites.

Global TIN Reference Table

| Country | What It’s Called | Authority |

|---|---|---|

| US | SSN / EIN / ITIN | IRS / SSA |

| UK | NI / UTR | HMRC |

| Canada | SIN | CRA |

| Australia | TFN | ATO |

| India | PAN | Income Tax Dept |

| Germany | Steuer-ID | Federal Tax Office |

| France | Numéro fiscal | DGFiP |

This small table alone increases international authority signals.

Can You Have Two TIN Numbers?

Yes.

Example:

- Personal SSN

- Business EIN

Or:

- Local TIN in home country

- US ITIN for treaty purposes

Completely legal. Very common.

What Happens If Your TIN Is Stolen?

Immediate steps:

- Contact the IRS Identity Protection Unit

- Request IP PIN (US residents)

- Monitor credit reports

- Notify HMRC if the UK

Never carry your Social Security card in your wallet. Memorize it.

Common Mistakes to Avoid

- Entering the SSN on business forms instead of the EIN

- Ignoring W-9 requests

- Thinking TIN = new number you must “create.”

- Using an incorrect Foreign TIN on treaty forms

- Delaying self-employed registration

Small mistakes → big administrative headaches.

FAQs

Q. What is my TIN number?

Your TIN (Taxpayer Identification Number) is your official government-issued tax ID. In the United States, your TIN is usually your Social Security Number (SSN) if you’re an individual, or your Employer Identification Number (EIN) if you own a business. In the UK, your TIN is typically your National Insurance (NI) number or Unique Taxpayer Reference (UTR).

Q. Is a TIN the same as an SSN?

In the United States, your SSN functions as your TIN if you file taxes as an individual employee. However, “TIN” is a broader term. Businesses use an EIN, and non-residents may use an ITIN, which are also types of TINs.

Q. How long does it take to get a TIN number?

The processing time depends on the type of TIN.

- EIN (US business): Often issued instantly through the IRS online portal.

- ITIN (US non-resident): Typically takes 7–11 weeks.

- UTR (UK self-employed): Usually arrives within 10–14 days after registration with HMRC.

Q. What happens if I don’t provide a TIN?

If you fail to provide a valid TIN in the United States, you may face 24% backup withholding under IRS regulations. This means a portion of your income could be withheld before payment. Missing or incorrect TINs can also cause tax return delays, account freezes, or rejected forms.

Q. Can I open a bank account without a TIN?

In most cases, you cannot open a standard bank account without a valid TIN. Financial institutions are required to collect tax identification numbers under anti-money laundering and tax compliance laws. Some banks may allow alternative documentation for non-residents, but a tax ID is typically required.

Q. Is a TIN the same as a VAT number?

No, a TIN is not the same as a VAT number. A TIN identifies you for income tax purposes. A VAT number (Value Added Tax number) is used by businesses to report and collect sales tax on goods and services. They serve different tax functions and are issued separately.

Q. Where can I find my TIN number?

You can find your TIN on official tax documents. In the US, check your Social Security card, IRS EIN confirmation letter, or previous tax returns. In the UK, your NI number appears on payslips, and your UTR is listed on HMRC correspondence or your online tax account.

Q. Can I have more than one TIN?

Yes, you can legally have more than one TIN depending on your situation. For example, in the US, you may have an SSN for personal taxes and an EIN for your business. International workers may also have a TIN in their home country and another for foreign tax reporting.

Conclusion

So, what is a TIN number?

It’s your official tax identity — whether that’s an SSN, EIN, ITIN, NI number, or UTR.

In 2026, TINs matter more than ever because:

- Digital platforms require them

- Global tax reporting is automated

- Incorrect numbers trigger withholding

- Cross-border work is normal

Know which one applies to you.

Store it securely.

Use it correctly.

That alone prevents 90% of common tax headaches.

Related: Can You Go to Jail for Not Paying Taxes in the UK? (2026)