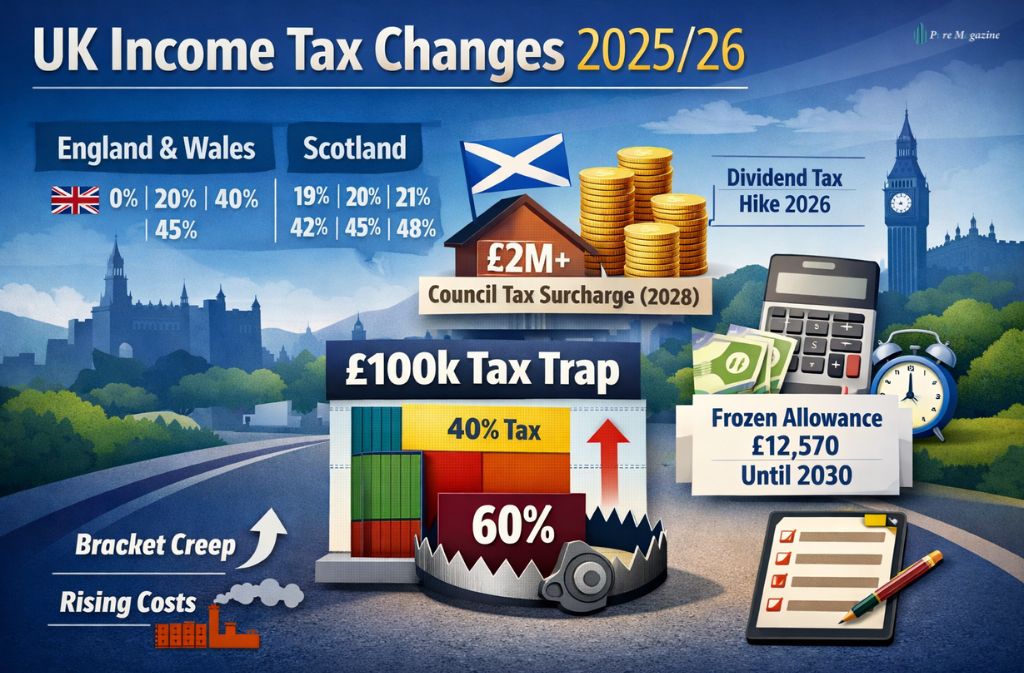

Income tax bands sound simple on paper, yet they remain one of the most misunderstood parts of the UK tax system. Every year, millions of people misjudge how much tax they owe, assume a pay rise has pushed all their income into a higher rate, or are caught out by stealth changes that don’t look like tax rises at all.

For the 2025/26 tax year, the story isn’t about dramatic headline rate increases (at least not in England). Instead, it’s about frozen thresholds, quiet structural changes, and targeted hikes that affect dividends, savings, and property income. Add Scotland’s move to a six-band system, including a brand-new Advanced Rate, and it’s no surprise many taxpayers feel lost.

This guide explains UK income tax bands clearly and accurately for 2025/26. You’ll learn how the income tax bands work, what has changed this year, how Scotland’s system differs from the rest of the UK, and how you can avoid common and costly mistakes — including the notorious £100,000 “60% tax trap.”

If you want a practical, plain‑English breakdown written for real people — not accountants — this is it.

What Are Income Tax Bands?

Income tax bands divide your earnings into slices, with each slice taxed at a different rate. The UK uses a progressive tax system, which means the more you earn, the higher the marginal rate you pay — but only on the portion that crosses each threshold.

Think of your income like filling a series of buckets:

- The first bucket is tax‑free (your Personal Allowance)

- The next bucket is taxed at the basic rate

- Each higher bucket is taxed at a higher rate

Crucially, you never pay one rate on your entire income.

UK Income Tax Bands for 2025/26 (England, Wales & Northern Ireland)

If you live in England, Wales, or Northern Ireland, these are the standard income tax bands for the 2025/26 tax year.

| Tax Band | Taxable Income | Rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Basic Rate | £12,571 – £50,270 | 20% |

| Higher Rate | £50,271 – £125,140 | 40% |

| Additional Rate | Over £125,140 | 45% |

Tax year: 6 April 2025 to 5 April 2026

The hidden impact of frozen thresholds

This is why many people feel worse off even without a formal tax rise.

Personal Allowance Explained (And the £100k Cliff)

The Personal Allowance is the amount you can earn before paying any income tax.

- Standard allowance (2025/26): £12,570

- Applies to most employees, pensioners, and the self‑employed

The £100,000 rule

Once your adjusted net income exceeds £100,000:

- Your Personal Allowance is reduced by £1 for every £2 over £100,000

- At £125,140, your allowance falls to zero

This creates an effective 60% marginal tax rate on income between £100,000 and £125,140.

Clear example: If you earn £110,000, you lose £5,000 of your Personal Allowance.

- £10,000 is taxed at 40% (£4,000)

- The lost £5,000 allowance is also taxed at 40% (£2,000)

That £10,000 slice of income triggers £6,000 of tax — an effective rate of 60%.

Scottish Income Tax Bands (2025/26): The New “Scottish Six”

If you live in Scotland, different income tax bands apply to non-savings, non-dividend income. For 2025/26, the Scottish Government introduced a new Advanced Rate alongside modest threshold increases aimed at protecting lower earners.

Scottish Income Tax Rates 2025/26

| Scottish Band | Taxable Income | Rate |

| Starter Rate | £12,571 – £15,397 | 19% |

| Basic Rate | £15,398 – £27,491 | 20% |

| Intermediate Rate | £27,492 – £43,662 | 21% |

| Higher Rate | £43,663 – £75,000 | 42% |

| Advanced Rate (New) | £75,001 – £125,140 | 45% |

| Top Rate | Over £125,140 | 48% |

The Personal Allowance remains £12,570, but Scotland now has the most progressive income tax structure in the UK.

Dividend, Savings & Property Tax: The 2025–2027 Roadmap

There has been understandable confusion around dividend, savings, and property income taxes following the 2025 Budget. The key point is timing. Not all announced changes apply immediately.

Dividends (Applies from 6 April 2026)

Dividend tax rates do not change in the 2025/26 tax year. They remain at:

| Taxpayer Band | 2025/26 Rate |

| Basic Rate | 8.75% |

| Higher Rate | 33.75% |

| Additional Rate | 39.35% |

From 6 April 2026, these rates are scheduled to rise by 2 percentage points.

Savings & Property Income (Applies from 6 April 2027)

Starting April 2027, the government will charge higher rates—22%, 42%, and 47%—on savings interest and rental income. For the 2025/26 tax year, savings and property income remain subject to standard income tax rates once allowances are exceeded. Think of this as a roadmap of upcoming increases, not changes that will affect your 2025 tax bill.

Property Income: A Quiet Split in 2025

Rental income has traditionally been taxed at standard income tax rates. Starting in 2025, the government will tax some property income at slightly higher effective rates to account for the lack of National Insurance on rent.

Indicative rates used in parts of the UK include:

- Basic rate property income: 22%

- Higher rate property income: 42%

- Additional rate property income: 47%

Because the exact treatment can vary by location and how the 2025 Budget is implemented, landlords are advised to seek professional guidance.

How Income Tax Is Calculated: A Real Example

Salary: £35,000

- First £12,570 → taxed at 0%

- Remaining £22,430 → taxed at 20%

Income tax due: £4,486

You do not pay 20% on the full £35,000 — only on the portion above your Personal Allowance.

Also Check: Tax on Savings Interest: The Hidden Bite in Your Bank Balance

National Insurance Context: The 2025 “Double Whammy”

While employees benefited from a cut to 8% National Insurance in 2024, the 2025 Budget shifted pressure onto employers.

Employer National Insurance changes

- Employer NI increased from 13.8% to 15%

- The Secondary Threshold dropped from £9,100 to £5,000

Why this matters to you

Even if your own income tax band hasn’t changed:

- Employers face sharply higher payroll costs

- Pay rises may be smaller

- Employers may push harder for salary sacrifice arrangements

In short, frozen income tax bands plus higher employer NI often mean wage growth slows — even as tax takes a bigger share over time.

Common Income Tax Mistakes

- Assuming all income is taxed at one rate

- Ignoring Scottish band differences

- Forgetting dividend and savings hikes

- Falling into the £100k allowance trap

- Confusing income tax with National Insurance

Quick Checklist for 2025 Tax Efficiency

- ✔ Check your tax code (most people should see 1257L)

- ✔ Use pension contributions to stay out of higher bands

- ✔ Watch the £100,000 cliff carefully

- ✔ Review dividend and rental income exposure

- ✔ Don’t ignore NI — it still affects take‑home pay

FAQs

Q. What are the income tax bands in the UK for 2025/26?

For the 2025/26 tax year, the UK applies a progressive income tax system. In England, Wales, and Northern Ireland, the government taxes income at 0%, 20%, 40%, and 45%, depending on how much you earn above the Personal Allowance. Scotland uses a separate six-band system with different rates and thresholds.

Q. What is the new Scottish Advanced Rate?

The government introduced the Scottish Advanced Rate, a 45% income tax band, for the 2025/26 tax year. It applies to non-savings, non-dividend income between £75,001 and £125,140 for Scottish taxpayers. This rate sits between the Higher Rate (42%) and the Top Rate (48%).

Q. Is there a mansion tax in the UK in 2025?

The UK does not levy a mansion tax within income tax for 2025/26. However, the 2025 Budget introduces a council tax surcharge on residential properties valued over £2 million, which the government will implement starting in 2028. This surcharge does not affect current income tax calculations.

Q. Did the Personal Allowance increase in 2025?

No. The government froze the Personal Allowance at £12,570 for the 2025/26 tax year and plans to keep it frozen until at least 2030. As wages rise with inflation, more income becomes taxable or moves into higher tax bands—a process known as fiscal drag.

Q. Are dividend taxes higher in 2025/26?

No. The government keeps dividend tax rates the same for 2025/26: 8.75% (basic rate), 33.75% (higher rate), and 39.35% (additional rate). A 2% increase will take effect from 6 April 2026.

Conclusion

In the 2025/26 tax year, income tax bands in the UK continue to shape how much you actually take home. Although headline rates in England, Wales, and Northern Ireland have not changed, frozen thresholds mean more of your income now falls into higher tax bands. Meanwhile, Scotland’s six-band system — including the new Advanced Rate — increases the importance of knowing which rules apply to you.

As a result, understanding how income tax bands work is no longer optional. If you track your taxable income, plan around the £100,000 allowance taper, and stay aware of upcoming changes to dividends and property income, you can avoid unpleasant surprises. Ultimately, clear knowledge puts you in control and helps you make smarter tax decisions in 2025 and beyond.

Related: Standard Tax Code UK 2025: Check If Yours Is Correct