Payroll deadlines don’t wait—and neither do HMRC penalties. If you’re an employer trying to fix a coding error, submit PAYE correctly, or resolve a National Insurance question, the last thing you want is to sit through endless automated menus.

This 2026 guide gives you everything you need in one place: verified numbers, updated hours, step-by-step instructions to reach a human faster, and insider pro-tips to avoid unnecessary call drops.

Whether you’re a small business, payroll agent, or accountant, this is your definitive HMRC Employer Helpline resource.

Verified HMRC Employer Helpline Numbers (2026)

| Purpose | Phone Number | Notes |

|---|---|---|

| Employer Helpline | 0300 200 3200 | General PAYE, payroll, RTI, NI, penalties |

| PAYE Payment Advice | 0300 200 3401 | For general payment guidance |

| Missed Payment / Debt Management | 0300 200 3819 | For overdue payments or debt letters |

| Agent Dedicated Line | 0300 200 3311 | Accountants and payroll agents |

| SDLT (Stamp Duty Land Tax) | 0300 200 3510 | For property-related employer queries |

Helpline Opening Hours (2026)

| Day | Hours | Notes |

|---|---|---|

| Monday–Friday | 8:00 am – 6:00 pm | Standard employer helpline hours |

| Saturday | ❌ Closed | No longer standard in 2026 |

| Sunday | Closed | – |

| Bank Holidays | Closed | – |

⚠️ Seasonal Warning:

- January (Self-Assessment surge) → 45–60+ min waits

- First 2 weeks of April (Year-End) → 40–70 min waits

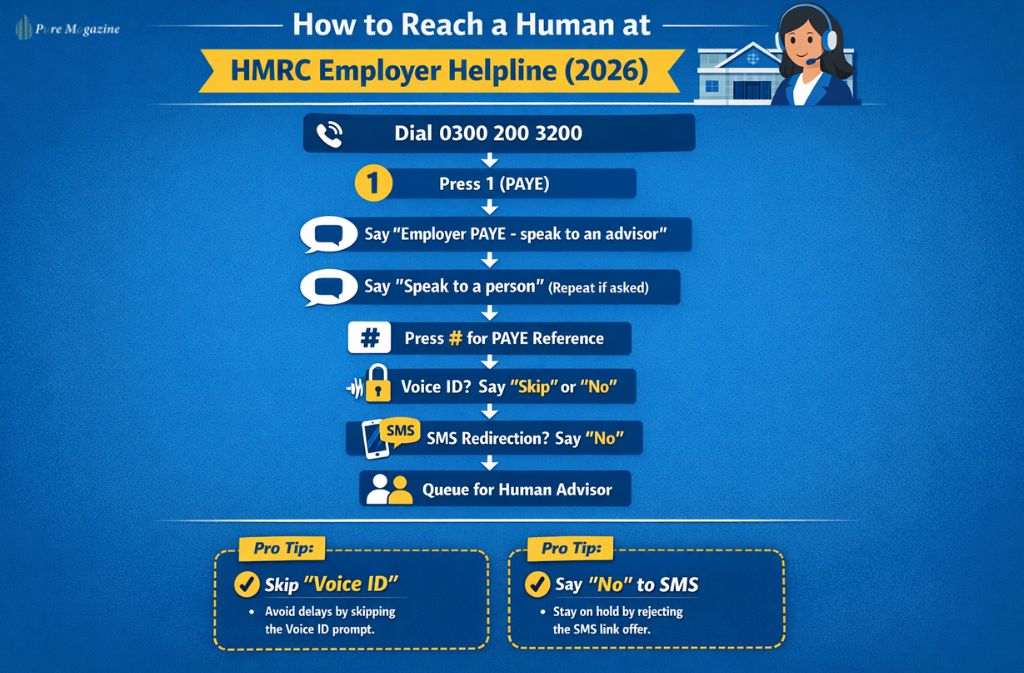

How to Reach a Human Faster (2026 IVR Shortcut)

Call 0300 200 3200 and follow these steps:

Step-by-step 2026 sequence:

1️⃣ Press 1 for PAYE

2️⃣ Say: “Employer PAYE – speak to an advisor.”

3️⃣ If asked again, say: “Speak to a person.”

4️⃣ Repeat if needed

5️⃣ Press # when prompted for PAYE reference

6️⃣ Voice ID Prompt: Say “Skip” or “No.”

7️⃣ SMS Redirection Prompt: Say “No” — if you accept, the call may disconnect automatically

8️⃣ You will enter the queue for a human advisor

PAYE Payment Lines (Updated)

- General Advice: 0300 200 3401

- Missed Payment / Debt Management: 0300 200 3819

This distinction is crucial to avoid being transferred multiple times.

Agent Line (2026)

- 0300 200 3311

- Dedicated to payroll agents or accountants.

- 10-minute service guarantee removed in 2023 → expect variable wait times.

Stamp Duty Land Tax (SDLT)

- 0300 200 3510

- Correct for 2026; mainly relevant for employers handling property transactions.

Best Times to Call HMRC

- Fastest: 8:00 am–9:30 am

- Moderate: 3:00 pm–4:30 pm

- Avoid: Mondays, lunch hours, the first working day after holidays

Also Check: M1 Tax Code Explained: What It Means and How to Fix It (2026 Guide)

What You Need Before Calling

Prepare these to speed up your call:

- Employer PAYE reference

- Accounts Office reference

- Contact details

- RTI submission info

- Employee NI numbers (if applicable)

- UTR (for agents)

- Details of any HMRC letters or penalties

Common Issues HMRC Handles

- Tax code errors

- Over/underpayment reconciliation

- RTI submission errors

- FPS/EPS mistakes

- P11D and benefits reporting

- Apprenticeship Levy

- CIS contractor verification

When You Don’t Need to Call

- Retrieve coding notices → use PAYE dashboard

- Correct minor payroll mistakes → adjust software directly

- Update employee details → payroll software suffices

Online Alternatives

- HMRC Business Tax Account

- PAYE Dashboard

- RTI submission portal

- P11D Online

- CIS verification online

These are faster than calling and are processed instantly.

2026 Insider Pro-Tips

- Voice ID: Skip it to reach a human faster

- SMS Redirection: Say “No” to avoid automatic call disconnection

- Call Early: 8 am sharp is best

- Seasonal Awareness: January + early April are peak wait times

FAQs

Q1: Is 0300 200 3200 still the main HMRC Employer PAYE helpline number?

Yes. In 2026, 0300 200 3200 remains the official HMRC Employer Helpline for all PAYE queries, including payroll issues, tax codes, and National Insurance. Use this number as your first point of contact.

Q2: Does HMRC Employer Helpline operate on Saturdays in 2026?

No. Saturday support has ended for the HMRC Employer Helpline. Standard operating hours are Monday–Friday, 8 am–6 pm. Plan calls during weekdays to avoid long waits.

Q3: What number should I call if my PAYE payment is late?

Call 0300 200 3819 — HMRC’s dedicated Debt Management line. This is specifically for employers who have missed a deadline or received payment reminder letters.

Q4: Will HMRC ask for Voice ID when I call?

Yes, HMRC increasingly prompts callers for Voice ID in 2026. To reach a human advisor faster, simply say “Skip” or “No” when asked. This helps bypass automated verification loops.

Q5: What should I do if the automated bot offers an SMS link?

Say “No”. Accepting the SMS link may automatically disconnect your call, as the system assumes your query is resolved. Saying no keeps you in the queue for a live advisor.

Q6: Where can I find my HMRC Employer PAYE reference number?

You can locate your PAYE reference through:

- Official PAYE letters from HMRC

- Business Tax Account online portal

- Payroll software used to submit RTI returns

Having this ready before calling drastically speeds up your HMRC Employer Helpline experience.

Q7: How can I reach a human quickly at the HMRC Employer Helpline?

Call 0300 200 3200, press 1 for PAYE, clearly say “Employer PAYE – speak to an advisor”, repeat “Speak to a person”, skip Voice ID, and say “No” to SMS redirection prompts. This 2026 shortcut reduces wait times significantly.

Q8: When is the best time to call the HMRC Employer Helpline in 2026?

The fastest times to reach a human advisor are 8:00–9:30 am and 3:00–4:30 pm on weekdays. Avoid Mondays, lunch hours, and early January or April peak periods for year-end submissions.

Conclusion

The 2026 HMRC Employer Helpline guide equips you with verified numbers, updated hours, shortcuts, and insider tips. By following these strategies, you can avoid long waits, bypass automated loops, and reach a human advisor quickly.

Key Takeaways:

- Use 0300 200 3200 for general employer queries.

- Missed payments: 0300 200 3819.

- Skip Voice ID and SMS Redirection for faster transfer.

- Call early morning outside peak months.

- Have references and documents ready before calling.

This guide is your definitive 2026 HMRC Employer Helpline resource — practical, actionable, and fully verified.

Related: W1/M1 Tax Code: Get Your Money Back (A Step-by-Step 2026 Fix)