Inheritance tax has a way of compounding stress at the worst possible moment. While families are still dealing with loss, they’re often confronted with a potential 40% tax charge on assets that may already have been taxed multiple times during the deceased’s lifetime.

What many people don’t realise is that UK inheritance tax law allows limited, lawful planning after death. A deed of variation can, in the right circumstances, redirect an inheritance and reduce the amount of inheritance tax payable—sometimes by six figures—without breaching HMRC rules.

Searches for deed of variation inheritance tax avoidance are rising because beneficiaries want clear answers, not dense legal explanations. They want to know whether it actually works, when HMRC accepts it, and where people go wrong.

This guide shows you exactly how deeds of variation work for inheritance tax, explains when they reduce tax and when they don’t, highlights common mistakes, shares real-world examples, and outlines the 2026 changes, including the new caps on Business and Agricultural Property Relief.

What Is a Deed of Variation?

A deed of variation lets beneficiaries change how an estate is distributed after someone dies, without rewriting the original will.

For inheritance tax (IHT) purposes, HMRC treats a valid deed of variation as if the deceased had written it into their will at the date of death. This “writing back” treatment is crucial—it’s what makes tax planning possible after death.

Why deeds of variation matter for inheritance tax

Normally, if a beneficiary receives an inheritance and later gives it away, that transfer is treated as their own gift, potentially triggering:

- Inheritance tax (subject to the 7-year rule)

- Capital gains tax

- Ongoing reporting obligations

A valid deed of variation avoids this. The redirected assets are treated as coming directly from the deceased person’s estate, not from the beneficiary.

Can a Deed of Variation Avoid Inheritance Tax?

Short answer: It can reduce—or sometimes eliminate—inheritance tax, but only in specific, HMRC-approved scenarios.

A deed of variation works for inheritance tax avoidance only when it redirects assets in a tax-efficient way, such as:

- Redirecting assets to a spouse or civil partner (spouse exemption)

- Leaving assets to a registered charity (charitable exemption)

- Redirecting assets to use nil-rate or residence nil-rate bands

- Structuring assets more effectively across generations

It does not remove tax automatically. HMRC accepts it only if:

- It is completed within 2 years of the date of death

- All affected beneficiaries agree

- The correct IHT election wording is included

- It is not used for income tax avoidance

HMRC Authority and Legal Basis (Why This Is Accepted)

The HMRC formally recognises deeds of variation under section 142 of the Inheritance Tax Act 1984.

When the statutory conditions are met, the variation is treated as if it were written into the will at the date of death—commonly known as the “writing back” provision.

This is confirmed in HMRC guidance, including:

- IHTM3501–IHTM3516 – Conditions for valid deeds of variation

- IHTM11022 – Effect on inheritance tax

- IHTM04057 – Spouse and charity redirections

For capital gains tax, s.62 Taxation of Chargeable Gains Act 1992 applies, meaning assets are rebased to market value at the date of death. This is why CGT is usually not triggered by a valid deed of variation.

These rules remain unchanged as of 2026.

Eligibility Checklist

Can You Use a Deed of Variation?

You can usually use a deed of variation if all of the following apply:

- The deceased died less than 2 years ago

- You are a beneficiary of the estate

- All affected beneficiaries consent

- The assets are redirected from the estate, not from you personally

- The deed includes the s.142 IHT election wording

- The variation does not aim to reduce income tax

- The estate value triggers or approaches the inheritance tax

- No payment or benefit is given for agreeing to the variation

If any of these are missing, the variation may fail for inheritance tax purposes.

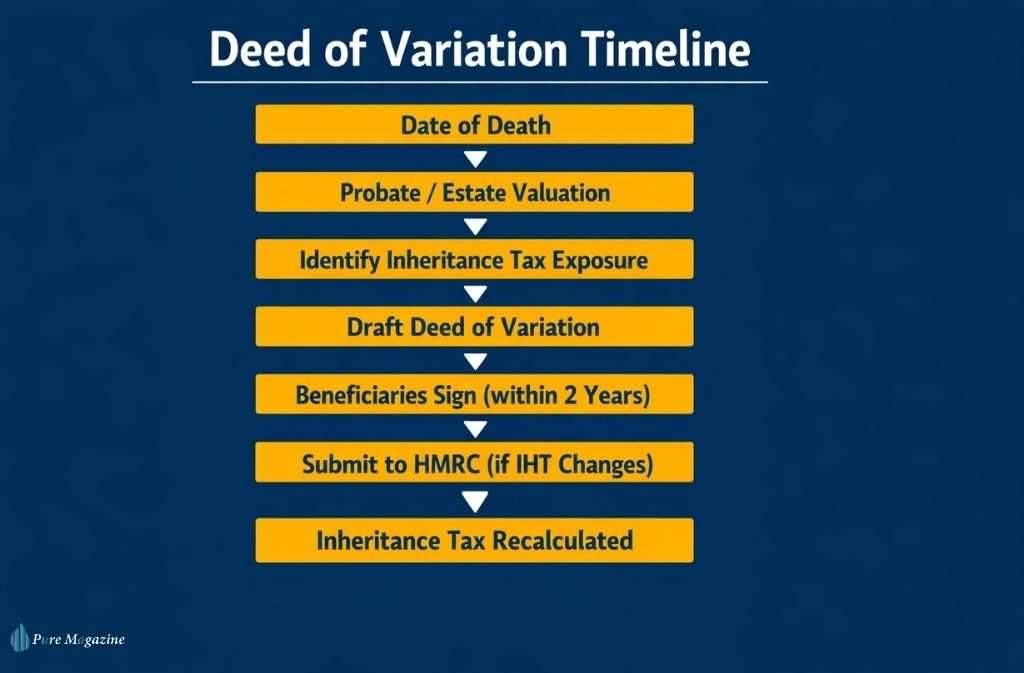

How a Deed of Variation Reduces Inheritance Tax (Step-by-Step)

Practical Legal Workflow

Estate Review

- Assess estate value

- Consider nil-rate band (£325,000)

- Consider the residence nil-rate band (up to £175,000)

- Account for unused spouse allowances

Identify Tax Exposure

- Calculate potential inheritance tax (IHT) liability

Plan the Variation

- Decide what share of the estate will be redirected and to whom

Draft the Deed

A solicitor prepares the deed, including:

- Details of the deceased and date of death

- Clear description of the variation

- Explicit s.142 election wording

Execution

- All affected beneficiaries sign the deed

HMRC Notification

- If inheritance tax changes, submit the deed with updated IHT forms

Tax Recalculation

- HMRC recalculates inheritance tax based on the varied estate

Scenario

- Estate value: £900,000

- Sole beneficiary: adult son

- Nil-rate band used: £325,000

- Taxable estate: £575,000

- IHT at 40%: £230,000

Variation

Within 18 months, the son executes a deed of variation:

- £300,000 redirected to the deceased’s spouse

- £50,000 redirected to a registered charity

Result

- Spouse exemption applies

- Charity exemption applies

- Taxable estate reduced significantly

Revised IHT bill: under £100,000

This is standard HMRC-accepted post-death estate planning.

Deed of Variation vs Gifting After Inheritance

| Feature | Deed of Variation | Gifting After Inheritance |

|---|---|---|

| Treated as from the date of death | ✅ Yes | ❌ No |

| 7-year rule applies | ❌ No | ✅ Yes |

| Immediate IHT efficiency | ✅ High | ⚠️ Limited |

| Capital gains tax risk | Low | Higher |

| HMRC scrutiny | Moderate | Lower initially |

The 7-Year Rule Explained (Clearly)

A valid deed of variation does not trigger the 7-year rule because the beneficiary is treated as never having owned the asset.

If the deed is invalid, HMRC treats the transfer as a normal gift—and the 7-year rule applies in full.

Does HMRC Scrutinise Deeds of Variation in 2026?

Yes—more than in previous years.

As of 2026, HMRC pays closer attention to:

- DIY or template deeds are missing election wording

- Charitable redirections aimed at accessing the 36% rate incorrectly

- Income tax avoidance misuse

HMRC does not pre-approve deeds of variation, but it can challenge them during post-probate reviews.

2026 Update: Business & Agricultural Property Relief Caps

From April 2026, HMRC will cap 100% relief for Business Property Relief (BPR) and Agricultural Property Relief (APR) at a combined £1 million.

This makes deeds of variation more important than ever.

If everything passes to an exempt spouse on the first death, the £1m relief can be wasted. A deed of variation allows families to:

- Redirect qualifying assets

- Use the £1m allowance on the first death

- Reduce inheritance tax on the second death

For estates with business or farm assets, a deed of variation is now a core planning tool, not an optional extra.

The 36% Charity Rule (Important Note)

Leaving at least 10% of the baseline amount to charity can reduce inheritance tax from 40% to 36%.

The baseline calculation is complex and easy to get wrong. Professional calculation is strongly recommended—errors can void the reduced rate entirely.

Also Read: Labour Retirement Tax: The Truth They Didn’t Tell You About Your Pension

When NOT to Use a Deed of Variation

A deed of variation is usually inappropriate if:

- The estate is already below the IHT thresholds

- You rely on the inheritance for income

- Beneficiaries do not fully agree

- The purpose is income tax reduction

- Overseas assets complicate jurisdiction

- The 2-year deadline has passed

- Family disputes are likely

- The variation creates CGT elsewhere

- Business or agricultural relief is misunderstood

FAQs

Q1. Can I avoid inheritance tax with a deed of variation?

Yes. A deed of variation can reduce or even eliminate inheritance tax if it meets HMRC rules. This requires redirecting the inheritance in a tax-efficient way, such as to a spouse, charity, or children. Make sure the deed is executed correctly within 2 years of the date of death.

Q2. Does a deed of variation affect capital gains tax (CGT)?

Usually, they don’t. For tax purposes, HMRC treats assets as if they passed directly from the deceased, which resets the base value to the market value at the date of death (TCGA 1992 s.62). This generally prevents capital gains tax when beneficiaries redirect the inheritan

Q3. What is the deadline for a deed of variation?

A deed of variation must be completed within 2 years of the date of death. HMRC will not accept variations submitted after this deadline for inheritance tax purposes.

Q4. Does HMRC need to approve a deed of variation?

No. HMRC does not pre-approve deeds of variation. However, it can challenge any variation that is invalid, abusive, or intended to reduce income tax improperly.

Q5. Can you do a deed of variation after probate has been granted?

Yes. Granting probate does not stop beneficiaries from executing a valid deed of variation. They can still make the variation within the 2-year statutory window, even after probate has been issued.

Q6. Who can use a deed of variation to reduce inheritance tax?

Beneficiaries of the estate can use a deed of variation if all affected parties agree, and the change redirects assets from the estate, not personal gifts. This includes spouses, children, or charities, depending on the estate’s circumstances.

Conclusion

A deed of variation is one of the few lawful ways to plan inheritance tax after death. When used correctly, it can protect family wealth, align outcomes with real intentions, and reduce unnecessary tax.

But it isn’t automatic or risk-free. Timing, wording, and purpose matter. With professional advice, it remains one of the most powerful post-death estate planning tools available under UK law.

If you’re considering a deed of variation inheritance tax avoidance, the most important step is to act before the 2-year window closes.

Related: Stamp Duty Land Tax Return 2026: How to File, Rates & Deadlines