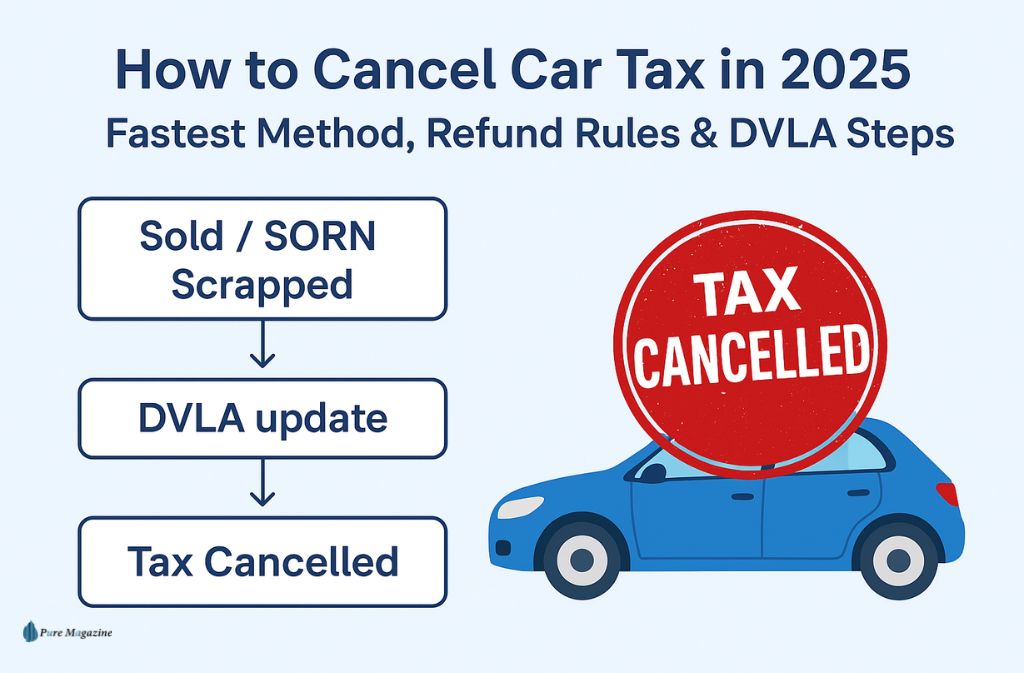

Cancelling your car tax sounds straightforward — until you actually try to do it. Most people don’t know whether they should report the sale first, file a SORN, cancel their Direct Debit manually, or wait for DVLA to issue a refund automatically. And because the rules changed recently, older advice online can be misleading.

If you’re searching “cancel car tax”, you’re likely in one of five situations:

- You sold your car

- You scrapped or wrote off your car

- The car is stolen

- You want to take it off the road (SORN)

- You want to stop your Direct Debit

This guide breaks everything down into clear, friendly steps — including exactly what DVLA needs, how refunds work, what to do if you lost your V5C, and a simple checklist so you don’t get fined.

This article uses updated 2025 processes, real examples, and the official DVLA rules — all explained in human language.

When You Need to Cancel Car Tax (All Scenarios)

Car tax doesn’t work like a subscription; you have to manually stop it.

It ends automatically when DVLA is told something has changed.

Here are the situations where the car tax should be cancelled:

1. You sold your car

DVLA cancels the tax as soon as you notify them of the sale.

2. You transferred ownership

Tax does not transfer to the new owner.

You get a refund for the full remaining months.

3. The car is written off or scrapped

The insurer or scrapyard will notify DVLA — but you can report it too.

4. The car was stolen

As soon as it’s marked stolen, tax stops.

5. You want the car off the road (SORN)

SORN automatically cancels your tax.

6. You want to cancel your Direct Debit manually

If DVLA already knows the car is sold/SORN/scrapped → Direct Debit stops itself.

If you cancel DD before notifying DVLA → you may get fined.

Need to report a car with no tax? Check out our full 2025 guide for step-by-step instructions.

Can You Cancel Car Tax Online?

Yes. You can do almost everything online.

✔ Official DVLA Online Car Tax Cancellation Page

(As referenced by GOV.UK)

- Vehicle tax refund: gov.uk/vehicle-tax-refund

- Cancel Direct Debit: gov.uk/vehicle-tax-direct-debit/cancelling

Step-by-Step: How to Cancel Car Tax in 2025

Below is the fastest and safest method depending on your situation.

If you sold your car

1 — Go to DVLA’s “Sold a vehicle” service

You can do this online using the V5C logbook.

2 — Enter the new owner’s details

3 — DVLA updates ownership instantly

4 — Your car tax is automatically cancelled

5 — DVLA issues a refund for the full months left

Example:

If you sold your car on the 10th and had tax paid until March, you’ll get refunded for the months starting after the current month.

If you scrapped or wrote off the car

- Tell DVLA the vehicle was written off

- The insurer may do this, but don’t rely on them

- Tax ends the moment DVLA updates the status

Refund rules stay the same.

If your car was stolen

Contact the police first, then:

- DVLA cancels the tax when the car is officially recorded as stolen

- Refund issued for the full months left

No need for extra paperwork.

If you want to make the car SORN

A SORN automatically cancels tax.

Steps:

- Go to gov.uk/make-a-sorn

- Use V5C or V11 reminder

- Tax cancels immediately

- Refund sent for the remaining full months

If you’re unsure what SORN is or how it works, check out our complete guide on Statutory Off Road Notification here.

If you want to cancel your Direct Debit

There are two safe methods:

Method A — Automatic (recommended)

Once DVLA registers a sale, SORN, or write-off, → Direct Debit ends.

Method B — Manual (only do this if DVLA already knows)

Log in to your bank and cancel the mandate.

IF you cancel early without telling DVLA, you risk:

- Penalty fines

- Enforcement letters

DVLA Refunds: How Long Does It Take in 2025

DVLA sends refunds within 6 weeks, but in most cases, they arrive in 7–14 days.

Refund Method

| Scenario | Refund Trigger | Average Time | Notes |

|---|---|---|---|

| Sold car | Reported sale | 7–14 days | The new owner pays tax separately |

| SORN | SORN confirmed | 7–14 days | Refunds for full months only |

| Scrapped | Write-off registered | 1–3 weeks | Faster if the insurer notifies DVLA |

| Stolen | Police report updated | 2–6 weeks | Varies by police update timings |

| Change of ownership | DVLA update | 7–14 days | Automatic |

Checklist — Avoid Fines When Cancelling Car Tax

- ✔ Notify DVLA before you cancel Direct Debit

- ✔ Keep your V5C details up to date

- ✔ Don’t drive once the tax is cancelled

- ✔ If storing the car, file SORN

- ✔ Return or destroy number plates if scrapping

Common Mistakes People Make (2025)

1. Canceling Direct Debit before telling DVLA

This causes warning letters and potential fines.

2. Thinking tax transfers to the buyer

It doesn’t.

The buyer must tax the car immediately.

3. Expecting refunds for partial months

DVLA only refunds full months.

4. Forgetting to notify the insurer if the car is sold or scrapped

5. Not filing SORN when the car is off the road

Creates unnecessary fines.

Best Way to Cancel Car Tax

| Scenario | Best Method | DVLA Action | Refund? |

|---|---|---|---|

| Sold car | Notify DVLA of sale | Cancels tax | Yes |

| Off-road | File SORN | Cancels tax | Yes |

| Written off | Report to DVLA | Cancels tax | Yes |

| Stolen | Police notify DVLA | Cancels tax | Yes |

| Want to stop payments | Notify DVLA + wait | DD stops | Yes |

Example Case Study

“I sold my car on Facebook Marketplace — what now?”

- Go to the DVLA “sold a vehicle” page

- Enter new keeper details

- DVLA confirms the sale instantly

- Tax cancels automatically

- Refund arrives in ~10 days

- Buyers must pay tax before driving

This simple case is where most fines come from — because people cancel DD before reporting the sale.

Future Trends (2025+ DVLA Changes)

- DVLA phasing in digital-only reminders

- Less reliance on paper V5C by 2026

- Faster refund processing through automated systems

- Insurance-linked tax cancellation for write-offs

FAQs

Q1. How do I cancel my car tax online?

You don’t manually “cancel” it. Your car tax stops automatically when you tell the DVLA that the vehicle has been sold, transferred, scrapped, stolen, exported, or declared SORN. Once DVLA updates the record, your Direct Debit ends automatically, and any refund forthe full remaining months is issued.

Q2. Does the buyer inherit my car tax?

No. Car tax never transfers to a new owner. The buyer must tax the vehicle straight away, even if they plan to drive it home. Your own tax ends the moment DVLA registers the change of ownership.

Q3. How long does the DVLA refund take?

Most refunds arrive within 7–14 days, depending on payment method. DVLA notes that some cases can take up to 6 weeks, especially if documents are incomplete or the vehicle record needs manual review.

Q4. Can I cancel car tax without my V5C logbook?

Yes. You can still notify the DVLA that the vehicle has been sold, scrapped, or taken off the road without the V5C. If needed, you can also request a replacement V5C online before completing the update.

Q5. What happens if I cancel my Direct Debit before informing DVLA?

Stopping your Direct Debit first can trigger penalty letters or late-payment warnings, because DVLA still sees the vehicle as “taxed” but unpaid. Always notify DVLA first so the tax can end correctly and avoid fines.

Q6.Is declaring SORN the same as cancelling car tax?

Yes — declaring a SORN automatically cancels your car tax and stops your Direct Debit. But it only applies if the vehicle is kept off public roads. You cannot drive or park a SORN vehicle on a public street.

Q7. Do I get a refund if I cancel car tax mid-month?

DVLA only refunds full unused months. There’s no refund for part of a month, even if you cancel the tax on the first or second day of that month.

Conclusion

Cancelling car tax in 2025 is simple once you know the exact DVLA rule that applies to your situation. Whether you sold the vehicle, made it SORN, scrapped it, or it was stolen, the key step is always the same: notify DVLA first. That single action stops your tax, cancels Direct Debit, and triggers any refund. If you follow the steps in this guide, cancelling car tax becomes a calm, predictable process instead of a confusing one.

Related: Check My Road Tax Online (UK 2025) – Complete Guide to VED, MOT & Renewal