TL;DR Your marginal tax rate is the percentage of tax applied to your next pound or dollar earned — not your entire income. In a progressive tax system (like the UK and US), income is taxed in layers. Only the top portion of your earnings is taxed at the highest rate you reach. Moving into a higher tax bracket does not reduce your total take-home pay. |

Ever turned down overtime because you thought, “I’ll just lose it all in tax anyway”?

That belief has cost people thousands.

The confusion usually starts with one question: what is the marginal tax rate — and how does it actually work?

Many taxpayers think crossing into a higher tax bracket means all their income gets taxed at that higher percentage. It doesn’t. Tax brackets aren’t cliffs — they’re stairs. And you only pay the higher rate on the step you’re standing on.

In this 2026 guide, you’ll learn:

- The exact definition of marginal tax rate

- The marginal tax rate formula

- Real UK and US examples

- How it affects overtime, bonuses, and self-employed income

- Capital gains interaction

- Why fiscal drag is quietly increasing tax bills

- How to estimate yours quickly

By the end, you’ll not only understand it — you’ll use it strategically.

What Is Marginal Tax Rate?

A marginal tax rate is the percentage of tax applied to your last unit of taxable income — the next pound or dollar you earn.

It applies only to the highest income bracket you reach.

Most developed countries use a progressive tax system, meaning income is taxed in slices.

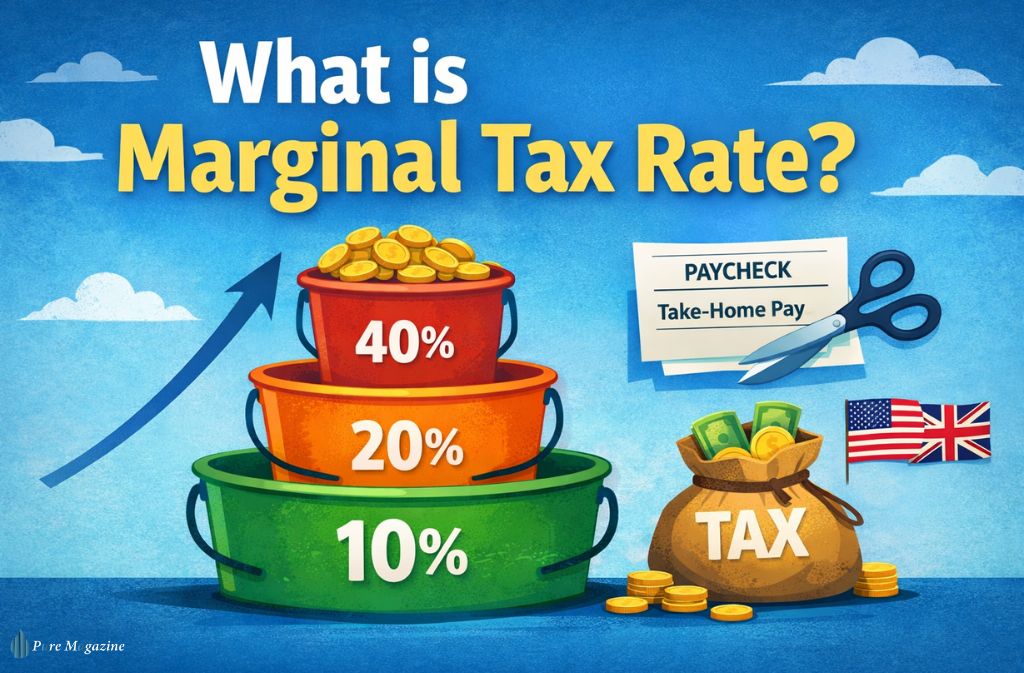

Think of tax brackets like stacked buckets:

- Bucket 1 → 0%

- Bucket 2 → 20%

- Bucket 3 → 40%

- Bucket 4 → 45%

You fill the first bucket before spilling into the next.

You don’t pour your entire income into the top bucket.

How Tax Brackets Work (2026 UK Example)

As of 2026 (England & Wales):

| Income Range | Rate |

|---|---|

| £0–£12,570 | 0% |

| £12,571–£50,270 | 20% |

| £50,271–£125,140 | 40% |

| Over £125,140 | 45% |

(Source: GOV.UK Income Tax Rates)

If you earn £60,000:

- First £12,570 → 0%

- Next £37,700 → 20%

- Remaining £9,730 → 40%

Your marginal rate = 40%

Your effective rate is much lower.

Marginal Tax Rate Formula

People search for this constantly — even though it’s simple.

Marginal Tax Rate Formula:

- Identify your taxable income

- Locate the highest bracket you fall into

- The rate attached to that bracket = your marginal tax rate

That’s it.

There’s no complex equation because it’s bracket-based.

How to Find Your Marginal Tax Rate (Quick Calculator Method)

If you want a fast estimate:

- Determine taxable income (after deductions)

- Check official tax brackets (IRS or GOV.UK)

- Match your income to the highest band

Optional deeper check:

- Subtract bracket threshold from income

- Multiply that top slice by the marginal rate

This helps you calculate how much extra tax applies to bonuses or overtime.

Does Moving Into a Higher Tax Bracket Reduce Take-Home Pay?

Short answer: No.

This is the biggest tax myth.

Only the portion above the threshold is taxed at the higher rate.

Example (UK)

Emma earns £49,500.

She receives a £2,000 bonus.

New income = £51,500.

Only £1,230 of that bonus enters the 40% band.

The rest stays in 20%.

Her take-home pay increases. Always.

You never earn less money by earning more — unless benefit tapering is involved (a different issue entirely).

Marginal vs Effective Tax Rate (With Example)

| Type | Meaning | Example |

|---|---|---|

| Marginal | Tax on last £/$ earned | 40% |

| Effective | Total tax ÷ total income | 19% |

If you pay £11,432 tax on £60,000 income:

Effective rate = 19.05%

Marginal rate = 40%

They serve different purposes:

- Marginal rate → decision-making

- Effective rate → overall burden

Marginal Tax Rate and Overtime

“Will I lose most of my overtime in tax?”

Not usually.

If overtime pushes you into a higher bracket:

Only the portion above the threshold is taxed higher.

Micro-Story (US Freelancer)

A freelancer earning $94,000 (2026 federal bracket 22%) hesitates to accept a $10,000 contract fearing the 24% bracket.

Reality:

Only income above the 22% threshold gets taxed at 24%.

They still keep the majority.

Fear often costs more than tax.

Federal Marginal Tax Rate (US 2026 Overview)

As of 2026 (IRS brackets adjusted for inflation):

| Taxable Income | Rate |

|---|---|

| 10% bracket | Lowest tier |

| 12% | |

| 22% | |

| 24% | |

| 32% | |

| 35% | |

| 37% | Highest federal marginal rate |

(Source: IRS Federal Income Tax Tables)

State income tax may layer on top, increasing total marginal exposure.

Example:

California resident earning into 24% federal bracket + 9.3% state bracket = effective marginal exposure over 33%.

Marginal Tax Rate for Self-Employed

Self-employed individuals face:

- Income tax (progressive)

- Self-employment tax (US) or Class 2/4 NICs (UK)

Your marginal tax rate may feel higher because:

- Additional income triggers both income tax and social contributions

- Deduction planning becomes critical

Planning levers:

- Pension contributions

- Business expense timing

- Income deferral

Marginal Tax Rate on Capital Gains

Capital gains are often taxed separately.

In the UK:

- Basic-rate taxpayers pay lower CGT rates

- Higher-rate taxpayers pay higher CGT rates

In the US:

- Long-term capital gains rates (0%, 15%, 20%) depend on taxable income

Meaning:

Your ordinary income can push capital gains into a higher marginal band.

Tax stacking matters.

Fiscal Drag (Why More People Are Entering Higher Brackets)

Here’s the quiet 2026 issue.

The UK froze income tax thresholds until 2028.

According to the Office for Budget Responsibility (OBR), millions of additional taxpayers are projected to be pulled into higher tax brackets due to wage inflation.

This is called fiscal drag.

Your income rises with inflation.

Thresholds don’t.

Your marginal tax rate increases without real purchasing power gain.

It’s subtle — but powerful.

Flat Tax vs Marginal Tax Rate

Flat tax system:

- One single rate on all income

Progressive (marginal) system:

- Different rates for different slices

Most developed economies use progressive systems to increase taxation on higher earners.

Are You Near a Tax Threshold? (Checklist)

You may need planning if:

- You’re within £3,000/$5,000 of a higher bracket

- You expect a bonus

- You’re selling investments

- You’re self-employed with uneven income

- You’re contributing to a pension irregularly

Small timing adjustments can reduce marginal exposure.

Should You Contribute More to Pension at Higher Marginal Rates?

Higher-rate taxpayers often gain more benefit from pension contributions.

Why?

Because tax relief applies at your marginal rate.

If your marginal rate is 40%, a £1,000 pension contribution may effectively cost £600 net.

This is where marginal rates become strategic.

Marginal Tax Rate vs Flat Tax

Marginal system:

- Tax increases gradually

- Encourages redistribution

Flat tax:

- Simpler

- Same rate for all income

Most countries use marginal structures.

FAQs

Q. What is marginal tax rate in simple terms?

A marginal tax rate is the percentage of tax you pay on your next pound or dollar earned. It does not apply to your entire income — only the portion of income that falls within your highest tax bracket. In a progressive tax system, income is taxed in layers, not all at once.

Q. How do I calculate my marginal tax rate?

To calculate your marginal tax rate, determine your taxable income and identify the highest tax bracket you fall into. The rate assigned to that bracket is your marginal tax rate. You can find current tax brackets on official government websites such as IRS.gov (US) or GOV.UK (UK).

Q. What does a 22% tax bracket mean?

A 22% tax bracket means the government taxes any additional income within that bracket at 22%. It does not tax all of your income at 22%. Instead, it taxes lower portions of your income at lower rates under progressive tax rules.

Q. Does moving into a higher tax bracket reduce take-home pay?

No, moving into a higher tax bracket does not reduce your overall take-home pay. Only the income above the new threshold is taxed at the higher rate. You always earn more net income when your gross income increases, assuming no benefit phase-outs apply.

Q. What is the marginal tax rate vs the effective tax rate?

The marginal tax rate applies a specific tax percentage to your last unit of income. To calculate your effective tax rate, divide your total tax paid by your total income. Your effective rate is usually lower because the tax system applies different rates to different portions of your income.

Q. Is marginal tax rate the same as federal tax rate?

In the United States, your marginal tax rate refers to your highest federal income tax bracket. However, state income taxes may apply separately, increasing your overall marginal tax exposure. In countries like the UK, marginal rate refers to your highest national income tax band.

Q. How do tax brackets work in a progressive tax system?

In a progressive tax system, income is divided into brackets, and each bracket is taxed at a different rate. You fill the lower brackets first before income spills into higher brackets. Only the income within each bracket is taxed at that bracket’s rate.

Q. Why does my marginal tax rate feel higher than my effective tax rate?

Your marginal tax rate applies only to your highest slice of income, while your effective tax rate averages tax across your entire income. Because lower income bands are taxed at lower rates, your effective rate is always lower than your marginal rate.

Conclusion

So, what is the marginal tax rate?

It’s the tax applied to your next pound or dollar earned — not your total income.

Remember:

- Brackets are stairs, not cliffs

- Earning more never reduces net income (in isolation)

- Fiscal drag is quietly increasing exposure

- Planning around your marginal rate can improve after-tax outcomes

If you’re near a threshold, review your numbers before year-end.

Understanding your marginal tax rate isn’t just academic — it’s financial leverage.

Related: Will UK Personal Allowance Rise in 2026? Latest Updates & Expert Guide